The Turtle Mindset

The turtle wins the race not by aiming for big (fast) wins, instead he stays on his path with a single minded focus.

Turtles carry their homes on their backs. Running her finger over the tattoo, she tells him what her dad told her: They’re exposed and hidden at the same time. They’re a symbol of strength and perseverance. – Christina Baker Kline

In the Aesop’s Fables “The Tortoise and the Hare”, the turtle wins the race not by aiming for big (fast) wins, instead he stays on his path with a single minded focus. Soon overtaking the hare, one little win at a time.

I was first introduced to the concept of winning by not losing early in my engineering career, when explained the relationship between costs, quality and profits. Say you are building widgets for $97 (cost) and are selling them for $100 (revenue). Making $3 (profit) per widget. You discover one of the widgets needs $9 of rework to fix a defect (quality). To draw even, or not lose money in your widget making venture you will need to make the next three widgets defect free. Another way to think of it, is that you are using the profits from the next three widgets to fix the defect. The moral of the story: build things right (quality), build things once (cost) and you will make money (profits). You lose money when you have to come back and fix mistakes.

Most people wouldn’t call gambling on a horse race an investment and so at this point I think it is important to separate investing from speculation. Just like business, personal investing is a marathon, not a sprint and you cannot win a marathon by going backwards. Successful long-term investing has more to do with avoiding loses then capturing unrealised gains[1]. Chasing +10 percent profits is speculation, a gamble not investing.

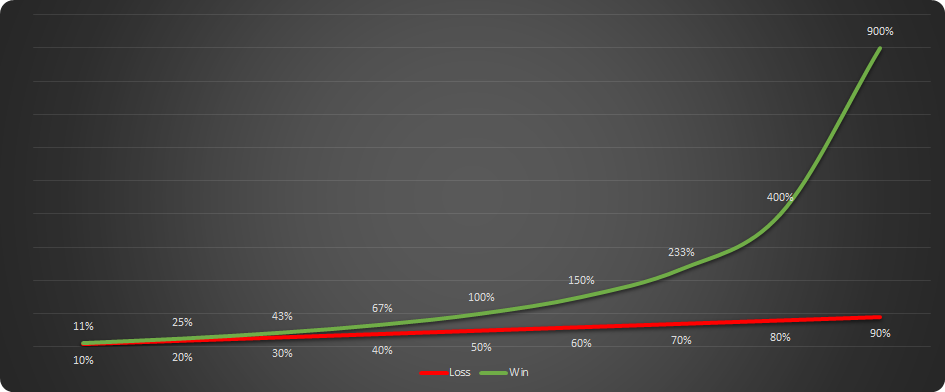

Say you invest $100,000 from your widget profits, but the investment doesn’t workout as planned and you lose $10,000. Taking a 10 percent loss. You reinvest the remaining $90,000 hoping to draw even with your original $100,000 investment. To draw even you need make $10,000 from a $90,000 investment, an 11 percent gain. And it gets exponentially worse as losses increase. A 20% loss will require a 25% gain and so on[2].

Original Investment: $100,000

| Investment Loss | Loss Percentage | Reinvestment Win | Reinvestment Return |

|---|---|---|---|

| $ 10,000 | 10% | $ 10,000 | 11% |

| $ 20,000 | 20% | $ 20,000 | 25% |

| $ 30,000 | 30% | $ 30,000 | 43% |

| $ 40,000 | 40% | $ 40,000 | 67% |

| $ 50,000 | 50% | $ 50,000 | 100% |

| $ 60,000 | 60% | $ 60,000 | 150% |

| $ 70,000 | 70% | $ 70,000 | 233% |

| $ 80,000 | 80% | $ 80,000 | 400% |

| $ 90,000 | 90% | $ 90,000 | 900% |

Win Loss - Percentage Graph

Watch the turtle. He only moves forward by sticking his neck out. – Louis V. Gerstner, Jr.

Richard Branson is known for his “Screw it let’s do it” tag line, but like all successful business people he always protects his down side. At the launch of Virgin Atlantic Branson negotiated with Boeing to buy back his plane if the venture didn’t work out[3], limiting the downside or loses to 6 months of Virgin profits. Yes you need to take risks (see “The Bold Mistake Instruction”), but betting the farm is rarely a good plan. Always protect your principle[4].